Credit Card Fraud Protection through AI App Development

Client is a FinTech Company which lends Credit Cards to Customers based on Financial profile. AI Platform built helps FinTech company to screen customers using the AI. Ezapp delivered the powerful AI Solution that allowed the company to identidy any Fraud Customers and Predict the Customers which were about to become defaulters in advance. Ezapp developed using Machine Learning models Lending Predictions, Loan Loss Predictions, Loan Recovery Rates Predictions, Business Revenue Optimization and Profitability predictions.

Business Challenges:

FinTech company having operations in London and New York was struggling with growing challenge of Credit Card Fraud Transactions. Leading business indicators pointed drop in the recovery rates as well as there was lack of insights on the lending performance of both Retail loans portfolio. Firm was struggling to form the team of Data Scientist to manage the pipeline of growing business and reduce the Operational risk by enhacing the Risk capabilities through Artificial Intelligence as there were limited resources having the expertize both in Finance domain and Ai.

Main challenges involved in credit card fraud detection are:

- Enormous Data is processed every day and the model build must be fast enough to respond to the scam in time.

- Imbalanced Data i.e most of the transactions (99.8%) are not fraudulent which makes it really hard for detecting the fraudulent ones

- Data availability as the data is mostly private.

- Misclassified Data can be another major issue, as not every fraudulent transaction is caught and reported.

- Adaptive techniques used against the model by the scammers.

GETTING THE DATA

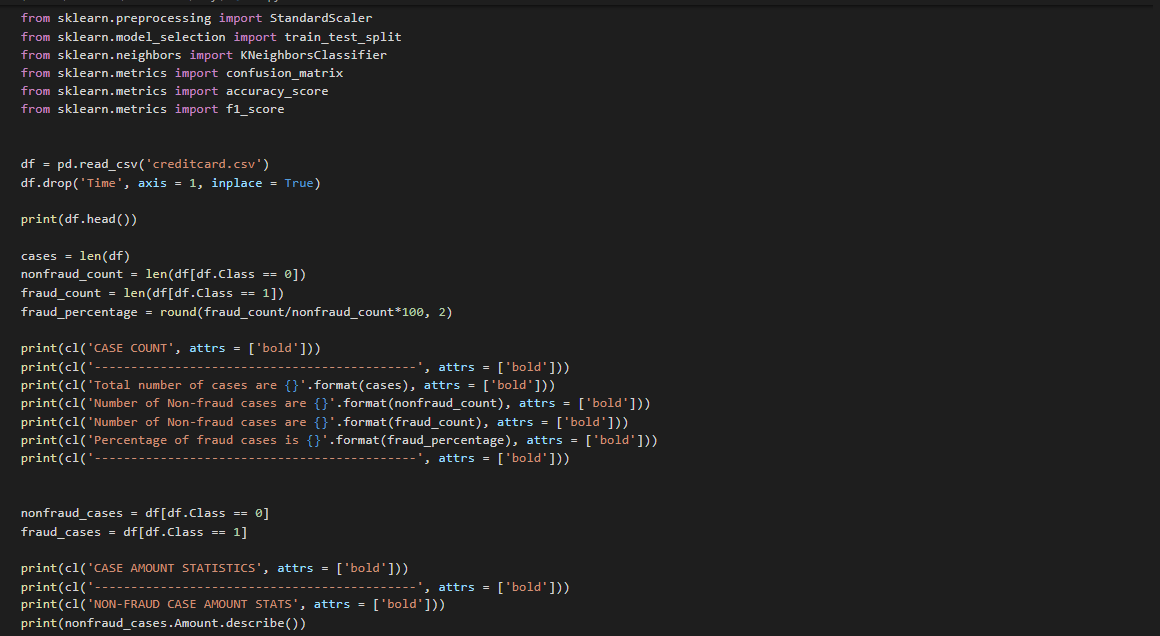

Before we start implementing the model, we need to get the data. I have uploaded a sample data.You can download the data on your local if you want to try on your own machine.

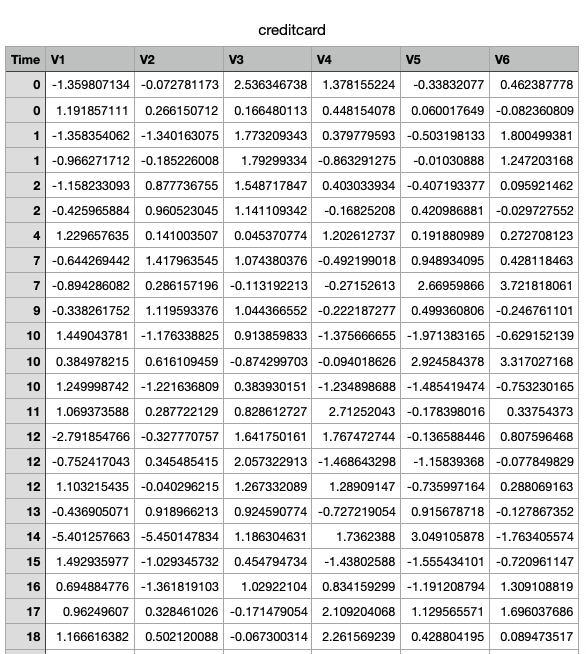

Given below are a few rows of our sample data, the dataset is from a Credit Card Given below are a few rows of our sample data, the dataset is from a Credit Card.

We drop those rows that have Nan in the Credit Card Dataset because that is our most important measure.

Solution:

Ezapp’s Enterprise Payments Fraud uses advance Deep learning AI models which considers robust behavioral profiling, anomaly detection and machine learning analytics for identification of loan and credit card transaction fraud. Using advance AI Tensorflow models, Ezapp has developed fraud detection accurately and efficiently, this allows timely detection of the payment frauds so that Financial Firm can benefit from payment risk and improve the governance of the transactions with ease by leveraging AI solution.

Credit Card Fraud Detection Solution Ezapp’s Card Fraud provides adaptive solutions for real-time detection and prevention of credit card fraud. The end-to-end process is thus managed, from detection to investigation to resolution, within a single financial fraud Management platform.

Final Thoughts!

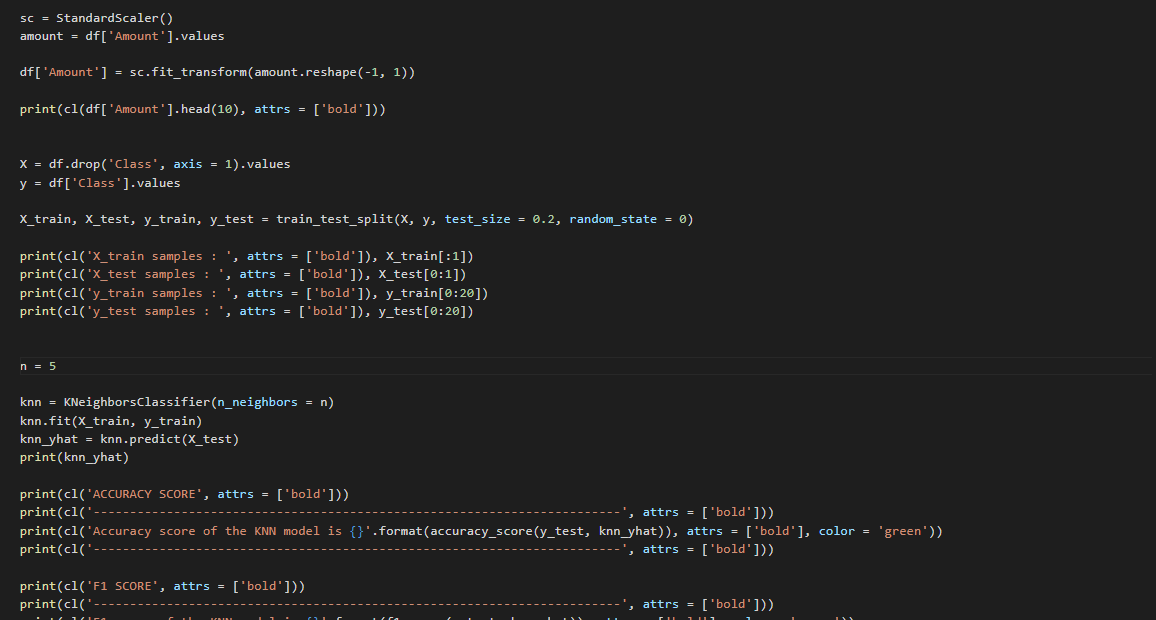

Finally, our model gives 95% of the Area Under the curve value. We can improve model results by adding applying additional data preprocessing techniques, etc.